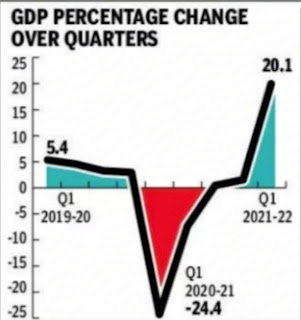

GDP.... IN THE SEVENTH HEAVEN? National Statistical Organisation released data on Tuesday 31/August/2K21 showed GDP growth rose 20.1% in the first quarter of the fiscal year 2021-22 compared with -24.4% in the same quarter of 2020-21 on Quarter over Quarter basis. 20.1% rise in GDP growth is once in a lifetime event but is it something walking on air? The figure shows a 20.1% growth rate look like we achieved massive success but when we compare the GDP growth rate of 2K19, 2K20 and 2K21 we found that it's just a cause of the low base effect. Let us understand the low base effect first with the diagram mention below. From the above figure, you can understand the situation of the low base effect. Suppose your salary in 2K19 is ₹20000 and in 2K20 your salary is ₹16000 after a pay cut of 20%. In 2K21 when situations healed your employer give you a pay rise on 22% of your current salary so your take-home is ₹19520. It looks like you got a 22% pay ...